College is so expensive, especially if you go to a university out of state! However, we are here to give you Ways To Save Money At College. Every penny counts and we have helpful tips to pinch those college pennies!

Everyone needs ways to save money at college. It is important to save money for college, however, once you are there, cutting costs during your college years is important to have zero college debt. Remember to dream for zero college debt, but if it doesn't happen, it is okay. Just do the best you can and make it as low as possible. And who knows, you may be able to stay debt free all through the college years!

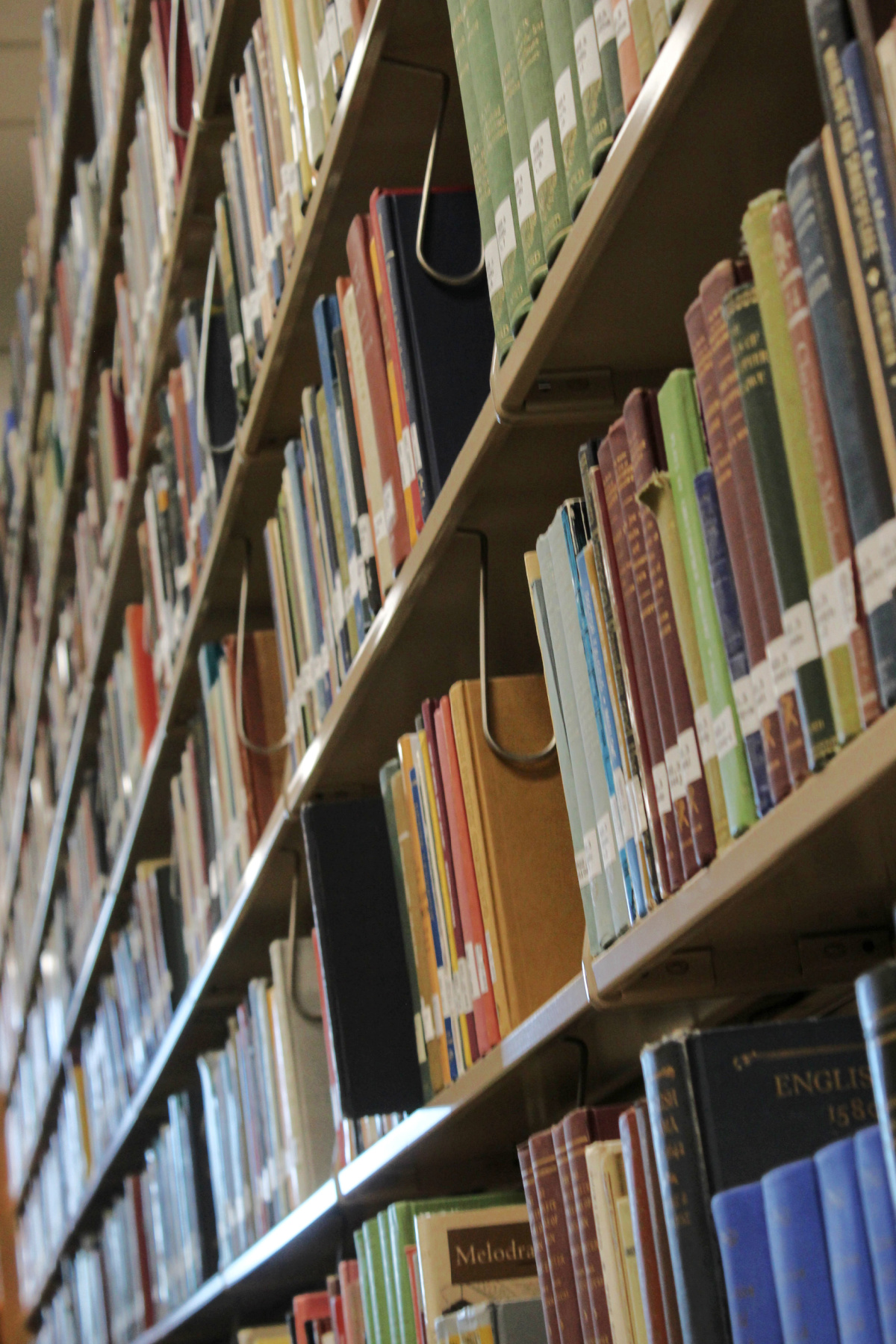

Textbooks

Textbooks are surprisingly a large amount of money for college students. The cost of books to buy is high and renting the books aren't much better. When I was in college, I feel the prices were much more reasonable, however, as with most college prices, they are on the rise.

Another problem we have found with textbooks, is sometimes they are on the class list to buy, but they aren't used one time! How frustrating and it is a major waste of money. Here are a few ideas on how to save money with college textbooks.

- If you must buy the book, buy it used. Can you put up with a few marks here or there?

- Borrow from a friend. Did you just have a friend go through the class? Borrow the book from her or offer to buy it from her. Take her out for coffee a few times. See if you can work out a deal.

- Look on Amazon! We did this so many times. Sometimes we were able to get the books for less than $10 used. Such a deal for books we don't use often.

- Does your school have a book deal? Our daughter's does and for a set amount, the books are delivered to her dorm room. We look up each individual book on Amazon and at their campus bookstore and found out the school was giving us a better than average deal on books, so we went with it. And she didn't have to do anything for it, they came to her!

Greek life

Oh Greek life. So many college kids want to be a part of fraternities or sororities. The problem (one of many, in my opinion) is that it costs so much to be apart of. There are housing fees, acceptance fees and clothes that need to be bought.

I am going to just say it, but parent after parent would talk about the debt their child is going to be in AND the parent plus loan they are going to have to take out, just for a chunk of it be for Greek Life. I am sure there are many who would argue the benefits of fraternities and sororities but I challenge that with the cost, the negatives (we all know what that would be) and the social effects of it all. I would encourage everyone to really weigh what the cost savings would be before you allow your child to be involved in Greek life.

Don't bring a car

Everyone wants a car and sometimes it is a necessity to go to a job off campus. The money savings is great, because if your child can't leave campus without a ride, the less money they will spend.

Buy your own food

Yes, if your child lives on campus, they will more than likely have a meal plan. However, they can choose the most inexpensive meal plan and plan accordingly.

For example, our oldest was in the room and board program. However, he chose the least expensive dorm and the least expensive meal plan. He did the math and realized he did not need 3 meals a day for 7 days a week for thousands of dollars. Instead, he planned to make his own breakfast (he is an oatmeal fan) with the microwave and fridge in the dorm room. He also made sandwiches with lunch meat or ate leftovers. He saved thousands. No need to spend what averages out to be $12 a meal on breakfast when he is happy with oatmeal for cents a bowl!

Get the free meals

If your child is in a college town, more than likely they can find free meals somewhere. There are specials going on at restaurants, free grab and go snacks at events or even on Sundays, some churches will feed college students. Be sure to look around and see what they can find.

Here are just a few ways to save money at college. Every penny counts at college and there are so many more ways to save a dollar or two and help your student stay out of (or reduce!) debt.

Leave a Reply